Movin’ on Up

My new boss, Jo, stood behind me. I was sitting in a strange area enclosed by carpeted walls extending just above my head. This would be my first introduction to a cubicle. Unbeknownst to me, this work setup would be an office norm for the rest of my professional future.

In early 1987, I would transform mounds of green files into the companywide blue format in this secluded area.

Jo walked me through the preferred layout for the sample insurance files scattered before me.

“The green files are from the new agency we purchased in South Dakota. Their layout is similar to ours, the blue ones. But we need to separate the photos of the insured property to the left and add our more detailed info sheet to the right. This consistency helps our underwriters better assess claims and answer customer service calls.”

Following along, I seamlessly ran through an example of my assigned task. Jo’s clear direction and a known end goal (all green files gone to be replaced by blue) were all I needed to be set loose.

My new employer was LeMars Mutual Insurance. Situated outside of the town where I attended college, they had advertised for a seasonal hire. Recruiting a college student from the school of business planning to remain in town through the summer, I fit the bill.

An accounting major, I was enamored with their new office building and the professionalism of the staff. Interviewing on the coveted second floor, I admired the well-suited executives in large glassed-in offices. I immediately pictured myself with an assigned desk and my own adding machine.

The lower lever was filled with scurrying workers and piles of neatly stacked folders in an open office layout.

I soon learned that the work I was applying for did not require skills from my accounting textbooks. I would be among the bottom floor bustle performing a labor-intensive office task estimated to last through the summer. Loving the feel of the overall business environment, I gladly accepted the job when offered.

Jo articulated the importance of my job as the first necessary step in the successful transition of the new company purchase. The underwriters were waiting for the completed blue files to begin their work. I knew the success of my job was crucial.

Green files were stacked in my cubicle, awaiting my arrival each morning. I created a system of efficiently transitioning paperwork between file folders. My stapler and two-hole punch were in a constant hum as I repositioned photos and paperwork into the company file layout.

I found the job fun instead of tedious. Photos of the insured home, car, boat, and other possessions of interest represented something worth enough for the owner to insure. Their potential loss meant something to someone.

Values were assigned and sometimes argued within the file notes. Concepts of replacement and fair market value further piqued my interest. Each file had a story that I carefully transferred into a new blue file folder.

No-nonsense would be the best description of Jo and one she would likely relish. With shortly cropped hair and no makeup behind her wire-rimmed glasses, she was quick to give instruction but short on sharing gratitude. As part of the executive team, suits were her required dress code. For Jo, this never included skirts or pantyhose but instead slacks with sensible shoes.

Each morning Jo would fill my space with enough green files estimated to keep me busy for the day. Tracking her down when the green piles were diminishing by midday, Jo continued to increase the morning load while I continued to transition at record speed.

With Jo’s guidance and daily check-ins, I quickly transformed the backlog of green files into end-of-day blues.

Two months into my new job, I walked into my cubicle to find no green files. The blue files I had finished the previous day were removed, leaving only my neat stacks of pens and supplies. Until I noticed a small box with a yellow sticky note attached.

“Thank you for your exceptional work and a job well done! ~ Jo”

The box was an assortment of Russell Stover chocolates. As I read the note with a blushing smile, I heard Jo behind me. Back to her no-nonsense ways, she shared how I finished a job slated for six months in just two months. There wasn’t a single green file left in the building.

“Great work, Sandy. If you want to stay on, I want to promote you to be an assistant to the underwriters. You know the files better than anyone. You can help them with the next step in this important transition.”

Holding my gift in one hand, Jo extended her hand to my other for a congratulatory handshake. I accepted the new position along with a raise.

I moved out of my solo cubicle into the larger communal cubicle with three underwriters and one shared computer terminal. Coming from my quiet file quarters, I loved the vibrant work environment of the underwriting ladies. I was assistant to three working women: A farmer’s wife, a young newlywed, and a grandmother almost to retirement.

They quickly took me under their wing as I eagerly performed the tasks given to me. Most familiar with the file notes of the newly acquired company, I guided them through document transition. I loved being a part of their team and helping with the success of the next transition milestone.

The working gals shared insights into their home lives and scoffed at the strict office rules. A high-pitched bell rang, precisely instructing when work was to begin and end. The same held true for the designated lunch hour. Down to the minute, there was no wiggle room in what represented a workday. No food or drink was allowed outside the lunchroom.

The first-floor workers were easy-going and light-hearted in contrast to the strictness of the rules they so disliked. We bonded as a team as we shared our lunch hours and personal lives. While teaching me that the human side of the insurance business was more than replacement value on their underwritten policies, we simultaneously conquered phase two of the purchase transition in record time.

Jo was thrilled with the completion of this phase and had another surprise of gratitude for me. This time it wasn’t a box of chocolates but a big move up the LeMars Mutual golden staircase.

“Sandy, I talked to the company Treasurer, and we have decided to promote you to the accounting department. You will move up to the executive suites on the top floor. This will be great for your resume, and you will get a nice pay raise!”

Thrilled, I accepted my new position and started the following Monday. Dressed in a skirt and pantyhose, I waved to my underwriting friends as I walked up to my newly assigned cushy desk. There were no cubicles on the executive floor. There were also no bells sounding to remind me of my workday. And there were rules against food or drink.

My job was to go through mounds of printed paperwork, checking in agency payments, and reconciling accounts receivable. Other jobs given to me were classic accounting: ticking and tying numbers from one piece of paper to another.

With mindless work and no understanding of how anything I was doing tied into a bigger picture, my dream job became a nightmare. Although now allowed Diet Coke at my desk, no caffeine level was high enough to keep me from a constant state of being drowsy and bored.

I missed my ladies on the first floor with a shared mission in our work and life. I missed daily status check-ins with Jo and reading through the green files full of notes and photos. I felt exiled outside the fancy and sterile offices of the C-Suite. Even Jo spent her time on the first floor, with her large office left dark and vacant most of the day.

The Treasurer barely acknowledged my presence, with only mandatory greetings the few times she would come out of her office. I later learned she was dealing with personal issues, which likely led to a poor work environment for those working for her. My work required almost no brain power, so questions requiring interaction with other accounting staff rarely happened.

I dreaded coming to work for those months I worked in accounting, my supposed coveted promotion. The minutes dragged on until the workday was finally over. I was reminded daily of what I was missing vs. what I was perceived to have on my daily walk up the stairs. Suited up, I would move up those steps away from my first-floor posse to the captive confines of floor two's important (but very dull) people.

My last months at LeMars Mutual Insurance ended uneventfully, with my giving notice and finishing my time. I walked away from my C-Suite desk without a goodbye or a note of gratitude. My underwriting friends greeted me at the bottom of the stairs with well wishes. I’m unsure which brought me more joy, the downstairs hugs or knowing I wouldn’t have to return upstairs again.

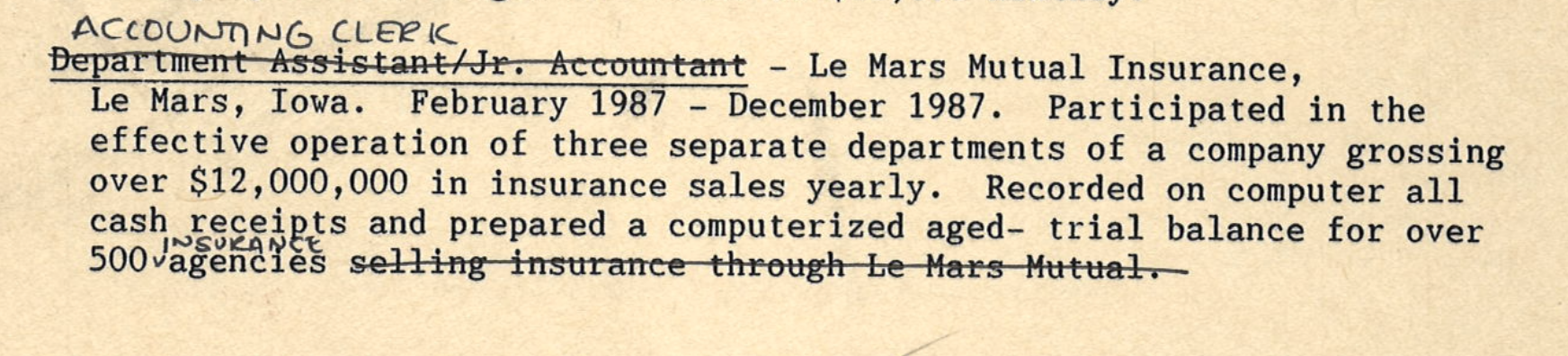

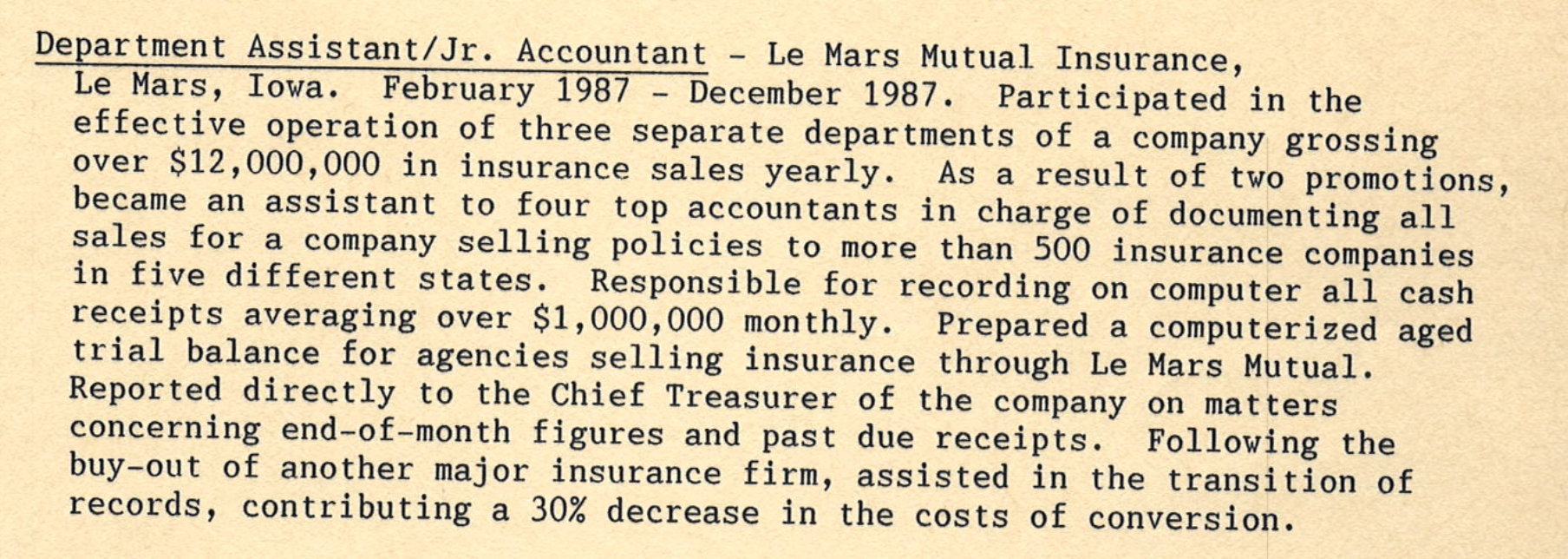

Recently I stumbled on my college resume composed to land my first job after graduation. There were two drafts that I have held on to over all of these years. Reflecting on my value proposition at LeMars Mutual, these job summaries are both comical and sad. While working there, I did great things for the company, but the resume write-ups did not reflect my highlight reel. Instead, as is typical of resume writing, I wrote what I thought my future employer wanted to hear rather than what I actually contributed to the job and got out of it.

Although I am past the days of resume writing, and my little stint at LeMars Mutual would no longer take up space on a recent resume, I decided to rewrite these work highlights.

I give you my real resume…

Sandy’s Real Resume:

Special Projects Assistant - LeMars Mutual Insurance, LeMars, Iowa. February 1987 - December 1987.

I was hired to complete a one-time project of transitioning file folders of insurance policies from a newly acquired insurance company into new files and a new format. It was considered a boring job, but I found a way to make it interesting and fun. I was told my role in transitioning these files was an important first phase. I took this responsibility seriously, working hard to cross the line to completion.

I worked to beat the six-month timeline I was given, ultimately completing it in 1/3 of the time budgeted and saving the company a lot of money. These savings were not only in my hourly wages but also in the few management hours needed to oversee me. I worked independently, excelling in my abilities as a self-starter and a problem solver. I won’t estimate the dollars saved as this would only be a broad guess, only to look good on paper. And that’s just not my style.

I won over my tough manager with my high work ethic and quality work (and…because I am good at winning over these sorts of people). Learning about the insurance business and being valued as a part of the master transition project, I was asked to continue to work on the next phase of the transition.

With this promotion in pay and responsibility, I joined a close team of ladies. They valued my ability to be a help and not a hindrance, always focusing on the efficiency of my work to the team’s end goal. I was trustworthy, easy to talk to, and they just plain liked me. Like them, I was not fond of the office bells and the rigid structure. But we followed the rules and found our own fun.

With this second phase of the purchased company transition, I again hit it out of the park by reaching milestones before the deadline, but this time as part of a cohesive team. We did it together, which made the experience even more meaningful. The team's success evolved around no one player taking more credit than another.

My last promotion was to accounting clerk to the company treasurer and her team of staff accountants. I have no idea how my daily work translated into the company financials, nor was I privy to any business volume or profitability indicators. I could get these numbers only by guessing, lying, or looking it up via an outside source. Since the reader of this resume can gather these numbers by the same means, and they had no impact on my work, I will omit a lengthy list of big impressive numbers.

I didn’t learn much about accounting in this position other than this was the most boring job out of the three I held at this company (although it was the most highly paid, and I’m told it looked the best on a resume).

Upon further reflection, perhaps the accounting department could have been a better fit for me with a little work on both sides. A bit more of Jo to better position me, knowing my strengths and value, would have gone a long way. Like my future years in public accounting, I could find a better-fitted role that added value to the department.

It was my first experience of how moving up on an org chart can be overrated. The biggest lesson I learned working for LeMars Mutual was that to love a job you must 1) contribute value, and then 2) be valued for this contribution. Lead by your value proposition in all you do, and you will never work a day in your life (or at least you won’t fall asleep at your desk).

This photo was taken in the spring of 1989 at my first job out of college (staff accountant at Peter Kiewit Sons). Different from my accounting role at LeMars Mutual, I always found myself energized at this job. Coincidently, my role here was in the accounting transition of a newly purchased company.